The just-concluded quarter (July to September 2025) was anything but upbeat for the world’s third-largest startup ecosystem. Amid escalating US-India trade uncertainties, Indian startups saw a 38% year-on-year (YoY) decline in funding activity in the third quarter (Q3) of 2025.

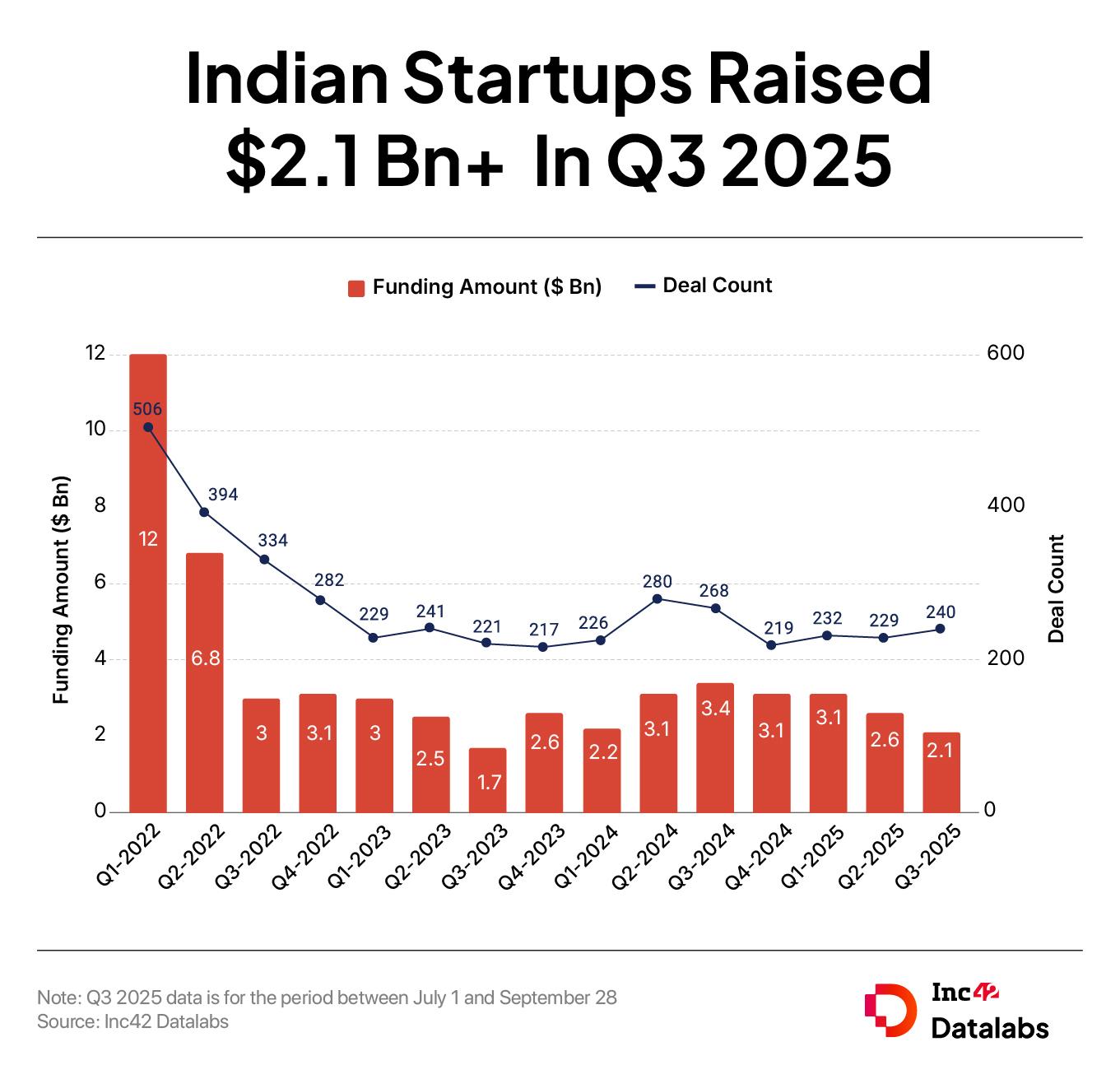

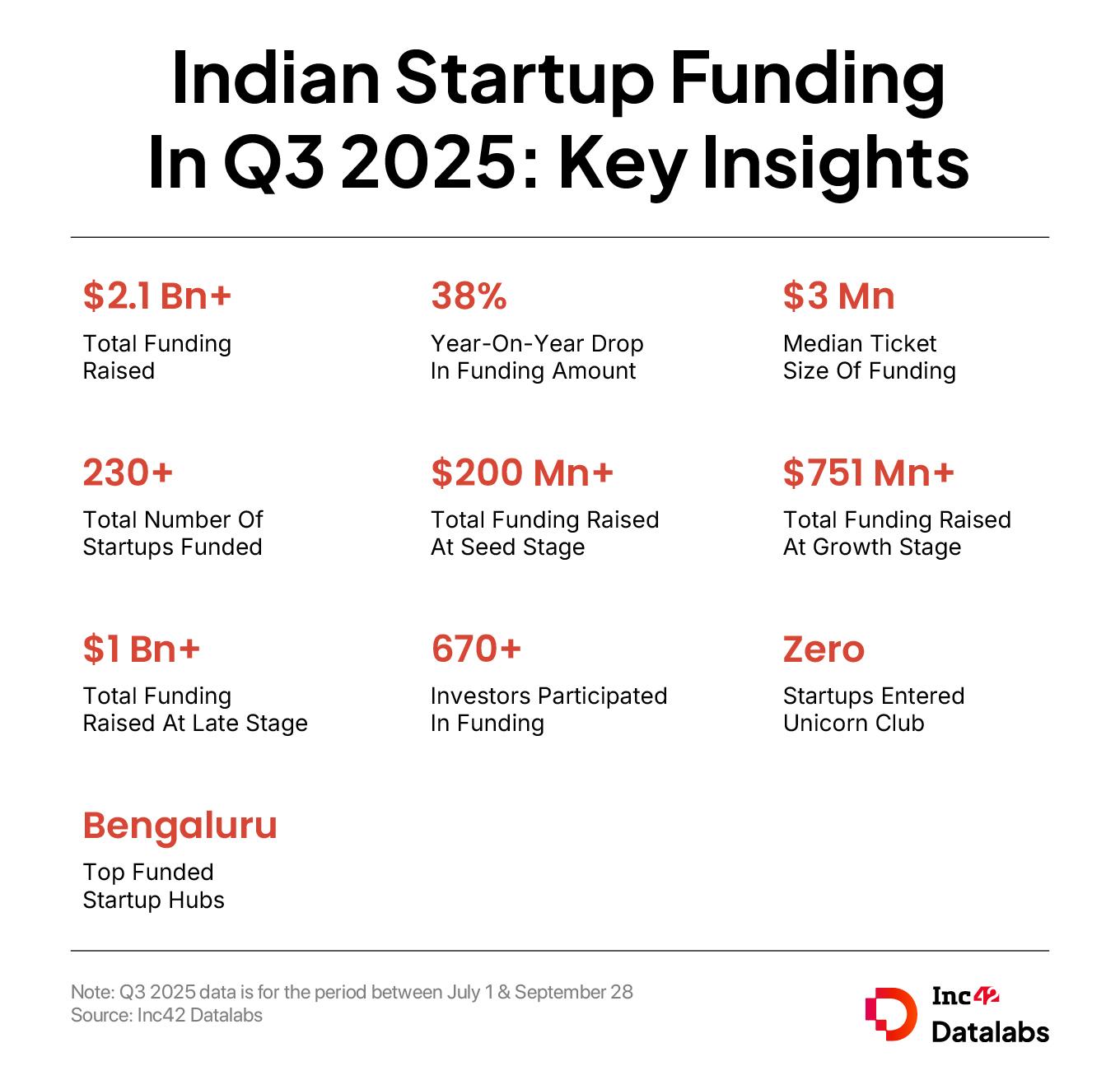

According to Inc42’s “Indian Tech Startup Funding Report, Q3 2025”, Indian startups managed to raise just over $2.1 Bn across 240 deals between July 1 and September 28, 2025. In the year-ago quarter (Q3 2024), the Indian startup funding stood at $3.4 Bn. This amount was raised across 262 deals.

Even on a quarter-on-quarter (QoQ) level, this was a 20% decline compared to $2.6 Bn raised by startups in Q2 2025.

Meanwhile, the median ticket size rose slightly to $3 Mn from $2.9 Mn in the same period last year, indicating investor focus on larger, growth-oriented cheques amid a cautious market environment. However, the metric did not budge sequentially.

Further, in the first nine months of the ongoing calendar year, Indian startups raised about $7.8 Bn across 701 deals, representing a 10% decline from the $8.7 Bn raised across 766 deals in the same period a year ago.

While Inc42 estimates this year’s total startup funding to conclude in the range of $14 Bn to $15 Bn, here’s how the startup funding at various stages (seed, growth and late) looked in the just concluded quarter.

Now, before we dive deeper into comprehending the Q3 story, here are the key funding trends of Q3 2025:

- Mumbai Overtakes Bengaluru As Startup Funding Hub: On deal count, Bengaluru retained the lead. But on the funding amount, Mumbai took the crown. Mumbai raised $617 Mn across 37 deals, overtaking Bengaluru’s $544 Mn across 76 deals. The surge in Mumbai’s totals was boosted by PharmEasy’s $192 Mn debt round.

- Funds Announced: Twenty-five investors announced funds worth over $2.5 Bn, with 17 targeting early stage startups. Overall, funds worth $9 Bn have been announced in 2025.

- M&A Activity Slowed Down: Consolidation activity declined 28% YoY to 13 from 18 in the same period last year and 44% sequentially from 23 M&As in Q2 2025.

- Unicorns In Hibernation: No new unicorn was minted in Q3 2025, compared to three in Q3 2024. In 2025, so far, five startups, namely Netradyne, Drools, Porter, Fireflies AI and Jumbotail, have entered the unicorn club.

Access Free Report

The 38% yearly decline in funding was visible across stages. With PharmEasy as the sole $100 Mn+ deal, no other mega rounds were recorded this quarter compared to 10 a year ago.

Due to this, late stage funding stood at approximately $1 Bn across 30 deals, representing a 54% YoY decline.

Besides PharmEasy’s debt funding, other large ticket rounds included TrueMeds’ $85 Mn Series C, IPO-bound Infra.Market’s $83 Mn funding, and Safe Security’s $70 Mn infusion.

Seed stage funding, too, couldn’t defy the trend, falling as much as 6% YoY to a mere $200 Mn that was raised across 110 deals. The median ticket size remained flat at $1 Mn both yearly and sequentially.

Despite this, 58% of investors surveyed by Inc42 are optimistic about early stage startups, thanks to the advent and adoption of artificial intelligence.

This is also visible in the seed funding pattern, about 60% of 80+ institutional investors surveyed have shared that approximately 20% of their portfolio is dedicated to investments in early stage AI startups.

Growth stage funding, however, witnessed some respite, declining only 16% YoY (the least of all) to $751 Mn across 65 deals. The median ticket size fell a mere 4% YoY to $8 Mn.

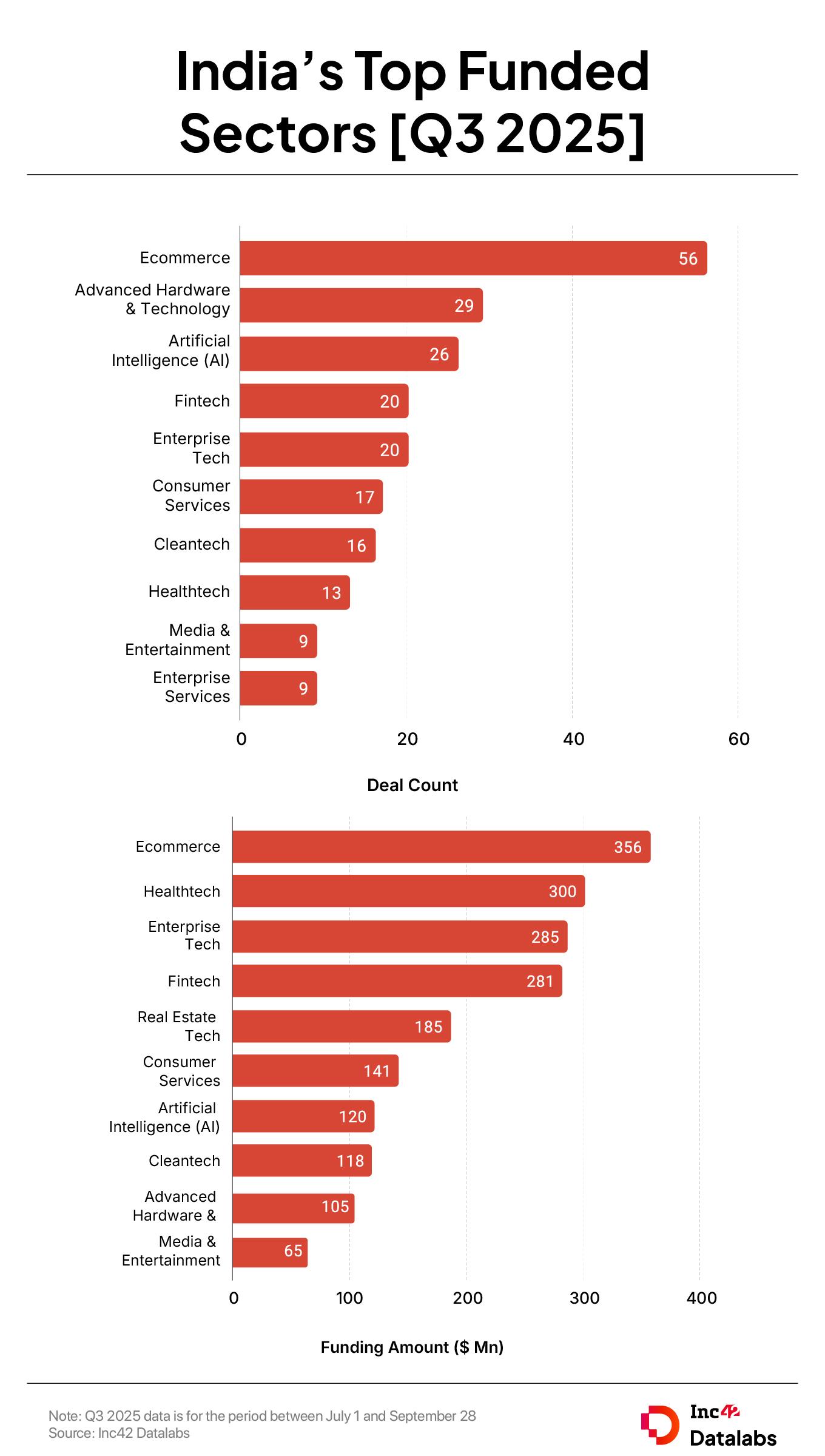

Ecommerce Startups Take The CakeEcommerce startups took the top spot on the funding podium, both in terms of total funding and deal count, with $356 Mn raised across 56 deals.

While ecommerce deal volumes drove much of the sector’s momentum, standout rounds like The Sleep Company’s $55 Mn funding andCityMall’s $47 Mn Series D helped ecommerce surpass traditionally top-funded sectors such as healthtech, enterprise tech and fintech, which raised $300 Mn, $285 Mn and $281 Mn, respectively.

Median ticket size for the Indian ecommerce startups stood at $6.4 Mn. For the second most-funded sector, healthtech, the median ticket size stood at $23.1 Mn. The sector raked in the funding ($300 Mn) in just 13 deals.

The advanced hardware & technology sector saw the second-highest number of deals (29), followed by AI (26 deals) and fintech and enterprise tech (20 deals each). The sector saw a fresh capital infusion of $105 Mn in the quarter. Indian hardware startups have raised $416 Mn across 72 deals so far this year.

Access Free Report

What’s Next On The Funding Cards?Looking ahead, investors remain cautiously optimistic about India’s startup ecosystem.

According to Inc42’s survey, 51% institutional investors see more investments going forward, while 27% remain cautious, citing factors such as evolving economic conditions and uncertain US-India trade relations.

In contrast, late stage and pre-IPO opportunities drew minimal optimism, with only 3% of respondents expressing confidence in funding at those stages.

Indian Startup Investor Survey Q3 2025 also revealed a clear preference for early stage startups, with 58% of investors bullish about angel, pre-seed, and seed rounds.

This indicates that innovation at the grassroots level will continue to attract capital, while investors will continue to adopt a selective approach toward high-ticket late stage rounds.

Access Free Report

[Edited by: Shishir Parasher]

The post Startup Funding Dips 38% To $2.1 Bn In Q3 2025 appeared first on Inc42 Media.

You may also like

Indian envoy meets visiting armed forces medical team in Washington

INS Imphal Engages in Naval Exercise with USS Gridley in Arabian Sea

Tragic Incident at Durga Puja Pandal in South Kolkata Claims Woman's Life

Bank Holiday 2025: Banks will be closed for 21 days in October, see the list of holidays from Dussehra to Diwali..

Gardeners warned over common mistake that could kill plants in heavy rain