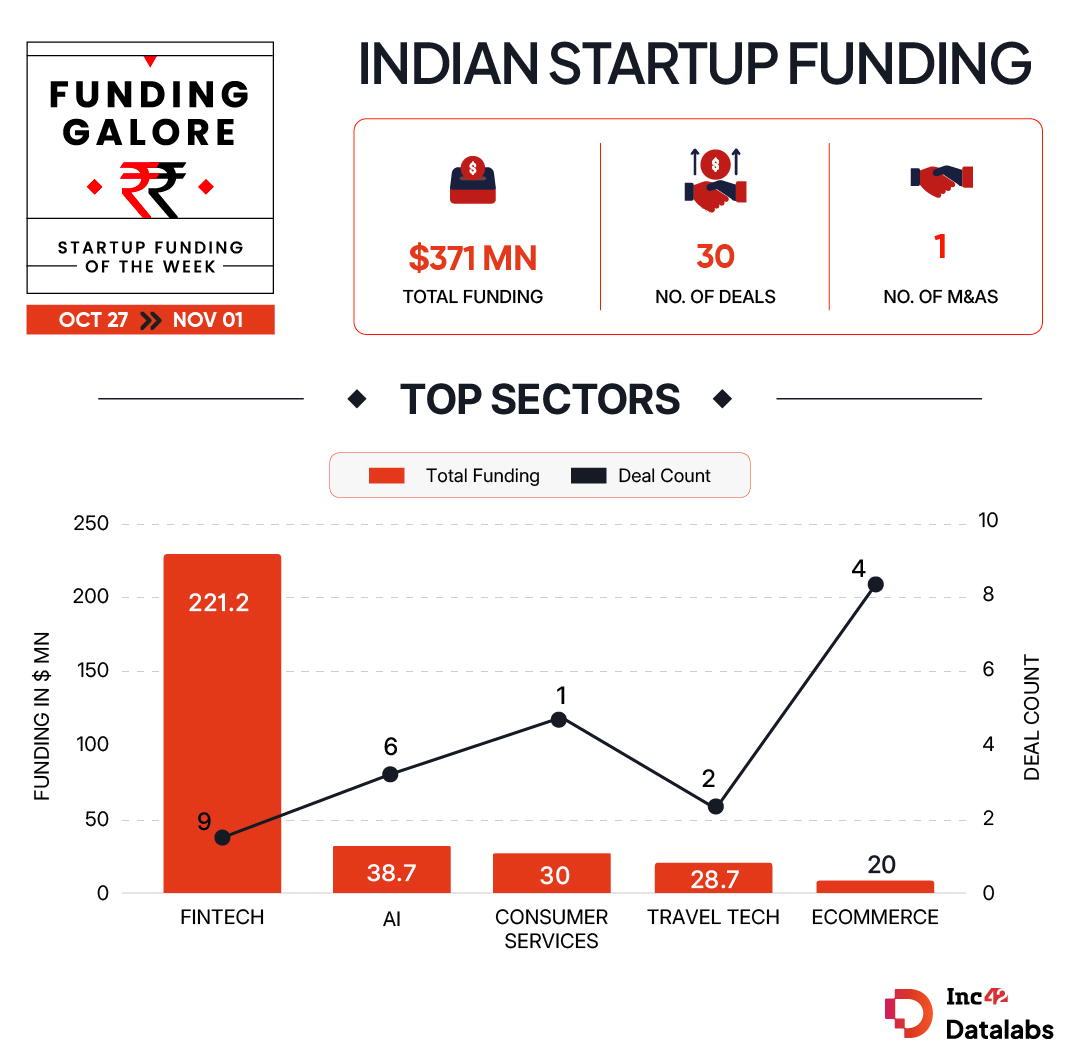

Funding momentum continued to remain strong in the Indian startup ecosystem towards the end of October. Between October 27 and 31, Indian startups cumulatively raised $371 Mn across 30 deals, marking a 19% uptick from the $312.5 Mn secured over a mere three deals in the preceding week.

Important to mention that the week also saw a $600 Mn secondary deal at PhonePe, with its investor General Atlantic doubling down on the fintech major in the run up to its IPO.

Funding Galore: Indian Startup Funding Of The Week [ Oct 27 – Oct 31]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 31 Oct 2025 | Snapmint | Fintech | Lending Tech | B2C | $125 Mn | Series B | General Atlantic, Prudent Investment Managers, Kae Capital, Elev8 Venture Partners | General Atlantic |

| 30 Oct 2025 | Drip Capital | Fintech | Lending Tech | B2B | $50 Mn | Debt | Toronto-Dominion Bank | Toronto-Dominion Bank |

| 30 Oct 2025 | Snabbit | Consumer Services | Quick Commerce | B2C | $30 Mn | Series C | Bertelsmann India Investments, Lightspeed, Elevation Capital, Nexus Venture Partners | Bertelsmann India Investments |

| 30 Oct 2025 | IntrCity SmartBus | Travel Tech | Booking Services | B2C | $28.2 Mn | Series D | A91 Partners | A91 Partners |

| 29 Oct 2025 | Mem0 | AI | Application Layer | B2B | $24 Mn | Series A | Basis Set Ventures, Peak XV Partners, Kindred Ventures, GitHub Fund, Y Combinator | Basis Set Ventures |

| 28 Oct 2025 | Optimo Capital | Fintech | Lending Tech | B2B | $17.5 Mn | Series A | Prashant Pitti, Blume Ventures, Omnivore | Prashant Pitti |

| 30 Oct 2025 | Jupiter | Fintech | Banking | B2C | $15 Mn | – | Mirae Asset Venture Investments, BEENEXT, 3one4 Capital, Jitendra Gupta (founder, Jupiter) | – |

| 31 Oct 2025 | GOYAZ | Ecommerce | D2C | B2C | $14.7 Mn | Series A | Norwest | Norwest |

| 31 Oct 2025 | Pluro Fertility | Healthtech | In-Clinic Healthcare | B2B | $14.1 Mn | Series A | Bessemer Venture Partners, Vikram Chatwal (chairman, Medi Assist), Dharmil Sheth (cofounder, PharmEasy), Hardik Dedhia (cofounder, AllHome Bharat Platform), Salil Musale (Astarc Ventures), Shalibhadra Shah (Motilal Oswal), Niket Shah (Motilal Oswal), Karan Kapur (director, K Hospitality) | Bessemer Venture Partners |

| 30 Oct 2025 | SalarySe | Fintech | Lending Tech | B2C | $11.3 Mn | Series A | Flourish Ventures, Susquehanna Asia VC, Peak XV Partners (Surge), Pravega Ventures | Flourish Ventures |

| 29 Oct 2025 | Lyzr | AI | Application Layer | B2B | $8 Mn | Series A | Rocketship.vc, Accenture, Firstsource, Plug and Play Tech Center, GFT Ventures, BGV (Benhamou Global Ventures), PFNYC (Partner Fund New York City) | Rocketship.vc |

| 30 Oct 2025 | PointAI | AI | Application Layer | B2B | $5.3 Mn | Pre-Series A | Yali Capital, Tremis Capital, Lip-Bu Tan (Walden International) | Yali Capital |

| 27 Oct 2025 | HYDGEN | Cleantech | Climate Tech | B2B | $5 Mn | – | Transition VC, Cloudberry Pioneer Investments, Moringa Ventures | Transition VC |

| 29 Oct 2025 | TSUYO Manufacturing | Cleantech | Electric Vehicles | B2B | $4.5 Mn | Pre-Series A | Avaana Capital | Avaana Capital |

| 30 Oct 2025 | Helex | Healthtech | Lifescience | B2B | $3.5 Mn | Seed | pi Ventures, Bluehill VC, SOSV | pi Ventures |

| 29 Oct 2025 | Fambo | Agritech | Market Linkage | B2B | $2.4 Mn | – | AgriSURE Fund, EV2 Ventures | AgriSURE Fund |

| 29 Oct 2025 | Oroos | Ecommerce | D2C | B2C | $2.3 Mn | – | Fireside Ventures, SBI | Fireside Ventures |

| 29 Oct 2025 | Happi Planet | Ecommerce | D2C | B2C | $2 Mn | – | Fireside Ventures, Prath Ventures | Fireside Ventures |

| 30 Oct 2025 | Openhouse | Real Estate Tech | Property Listing & Discovery | B2C | $2 Mn | Seed | IndiaQuotient, Mohit Gupta (Zomato), Gunjan Patidar (Zomato), Gaurav Sharma (SaaS Labs), Ramanshu Mahaur (Spinny) | IndiaQuotient |

| 30 Oct 2025 | Redacto | AI | Application Layer | B2B | $1.4 Mn | Seed | PeerCapital, Antler India | PeerCapital, Antler India |

| 30 Oct 2025 | Vijya Fintech | Fintech | Investment Tech | B2B | $1.4 Mn | Seed | – | – |

| 27 Oct 2025 | Neulife | Ecommerce | D2C | B2C | $1 Mn | Seed | Subhkam Ventures, Singularity Ventures, Sunicon Ventures, Cosma Ventures | Subhkam Ventures, Singularity Ventures |

| 29 Oct 2025 | SaveSage | Fintech | Lending Tech | B2C | $1 Mn | Pre-Seed | DSP Family Office, Venture Catalysts, Bhavesh Gupta, NR Narayanan, Lalit Wadhwa, Suvrat Sehgal | – |

| 30 Oct 2025 | Beyond Renewables & Recycling | Cleantech | Climate Tech | B2B | $563K | Pre-Seed | Momentum Capital, Venture Catalysts, IIMA Ventures, Oorjan Cleantech, Gautam Das (founder, Oorjan) | Momentum Capital |

| 29 Oct 2025 | StampMyVista | Travel Tech | Online Travel Agency | B2B | $451K | – | Unicorn India Ventures | Unicorn India Ventures |

| 30 Oct 2025 | Exiles Interactives | Media & Entertainment | Gaming | B2C | $355K | Pre-Seed | Chimera VC, Warmup Ventures, IndigoEdge, Dhruv Vohra, Sourav Gupta | Chimera VC |

| 27 Oct 2025 | FinalLayer | AI | Application Layer | B2B | – | – | Beyond Next Ventures | Beyond Next Ventures |

| 29 Oct 2025 | Satark AI | AI | Application Layer | B2B | – | Pre-Seed | Infynno Solutions | Infynno Solutions |

| 28 Oct 2025 | Cybrilla | Fintech | Fintech SaaS | B2B | – | Pre-Series A | 360 ONE WAM, Peak XV Partners, Groww | 360 ONE WAM |

| 29 Oct 2025 | Nova Nova | Ecommerce | D2C | B2C | – | Pre-Series A | Enrission India Capital | Enrission India Capital |

| 30 Oct 2025 | PhonePe | Fintech | Banking | B2C | $600 Mn* | Secondary Round | General Atlantic | General Atlantic |

| *Completely subscribed. Source: Inc42 Note: Only disclosed funding rounds have been included |

With lending tech startup Snapmint raising a mega round, fintech funding soared to the first position this week. Nine fintech startups raised $221.2 Mn.

With lending tech startup Snapmint raising a mega round, fintech funding soared to the first position this week. Nine fintech startups raised $221.2 Mn.- AI as a sector continued to be high on investor priority list as six AI startups cracked new funding deals, securing $38.7 Mn in total funding.

- Peak XV was the most active investor of the week, backing AI startup Mem0, lending tech SalarySe and Cybrilla.

- Nine startups at the seed stage raised $7.8 Mn this week.

- After raising INR 190 Cr in its pre-IPO round, Lenskart’s IPO opened on Friday to a strong investor response. The company’s public offering saw 110% subscription on day one.

- Fintech major Groww filed its RHPfor its INR 6,600 Cr IPO on Thursday. The company has set a price band of INR 95 to INR 100 for its IPO, which is scheduled to open on November 4.

- Months after receiving the greenlight for its confidential IPO papers, consumer electronics company boAt filed its updated DRHP with SEBI or an INR 1,500 Cr IPO on Wednesday. The company has cut its IPO size by 20% from INR 2,000 Cr IPO previously.

- Curefoods secured the markets regulator SEBI’s nodto proceed with its public listing. The company’s IPO would comprise a fresh issue of shares worth up to INR 800 Cr ($304 Mn) and an offer for sale (OFS) of up to 4.85 Cr equity shares.

- In a bid to modernise its offerings, conglomerate Dabur launched an INR 500 Cr venture arm to invest in emerging D2C startups across categories like personal care, healthcare, wellness foods, beverages and ayurveda.

- Gruhas and Collective Artists Network closed their maiden Gruhas Collective Consumer Fund (GCCF) at INR 100 Cr. The firm plans to raise an additional INR 50 Cr via a green shoe option. The fund is dedicated solely to consumer-facing startups.

- Blume Ventures announced thefirst close of its Fund V at $175 Mn. The funds would be allocated to back 30-35 startups, primarily from consumer, fintech, healthtech, and deeptech sectors.

- On the sidelines of its Q2 disclosures, foodtech giant Swiggy announced that its board would be mulling undertaking its first fundraise since listing. The company is planning to raise up to INR 10,000 Cr via a qualified institutional placement (QIP) for the expansion of its quick commerce vertical Instamart.

- Dairy company Heritage Foods is set to acquire controlling (51% stake) in D2C dessert brand Get-A-Way’s parent for INR 9 Cr.

- Stanza Living iseyeing the raise of INR 282.8 Cr (around $32 Mn) in a new round led by its early backer Accel and new investor Motilal Oswal.

- Ola Electric’s board approved the raise of INR 1,500 Cr in fresh capital via routes that could range from public offer, rights issue, QIP or private placement.

The post From Snapmint To Snabbit — Indian Startups Raised $371 Mn This Week appeared first on Inc42 Media.

You may also like

Major UK police force increasing specialist unit to tackle knife crime crisis

Double Black Friday discount on mattress that 'makes sleep so much better'

Inside eerie and abandoned city of hotels that has been 'left to rot' for three decades

Andrea Bocelli and son Matteo Bocelli duet Fall On Me in emotional new live video

Parsnips will be golden on the outside with a sweet and fluffy interior thanks to 1 method